The Minute Guide to Social Security Maximization and Financial Freedom

Social Security is a vital safety net for millions of Americans, providing a source of income during retirement, disability, and other life events. Maximizing your Social Security benefits can significantly enhance your financial security and help you achieve financial freedom. This comprehensive guide will empower you with the knowledge and strategies to optimize your Social Security benefits and plan for a secure and fulfilling future.

4.5 out of 5

| Language | : | English |

| File size | : | 1915 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 22 pages |

| Lending | : | Enabled |

Understanding Social Security Benefits

Social Security benefits are calculated based on your earnings history and the age at which you claim benefits. There are two main types of Social Security benefits:

- Retirement benefits: These benefits are available to individuals who have reached the minimum retirement age (62 for those born in 1964 or later) and have earned enough Social Security credits.

- Disability benefits: These benefits are available to individuals who have a qualifying disability that prevents them from working.

Claiming Social Security Benefits

The age at which you claim Social Security benefits has a significant impact on the amount you will receive. You can claim benefits as early as age 62, but your monthly benefit will be reduced if you do so before reaching your full retirement age (FRA). Your FRA depends on your birth year and ranges from 66 to 67.

Here are some key considerations when deciding when to claim benefits:

- Longer life expectancy: If you have a longer life expectancy, you may want to delay claiming benefits to maximize your total lifetime benefits.

- Health status: If you have a serious health condition, you may want to claim benefits earlier to secure income while you are able to enjoy it.

- Financial need: If you have a pressing financial need, you may want to claim benefits as early as possible.

Choosing the Right Retirement Age

The decision of when to retire is a complex one. Here are some factors to consider:

- Social Security benefits: The age at which you retire will impact your Social Security benefits. Retiring before your FRA will result in reduced benefits.

- Health and longevity: Your health and longevity can influence your retirement decision. Retiring earlier may give you more time to enjoy retirement, but it also means you may have less time to save.

- Financial situation: Your financial situation will play a key role in determining when you can afford to retire.

Utilizing Spousal Benefits

If you are married, you may be eligible for spousal benefits. These benefits are available to spouses who have reached age 62 and have a spouse who is receiving Social Security retirement or disability benefits. The amount of spousal benefits you receive depends on your spouse's earnings history and your own age.

Other Strategies for Maximizing Social Security Benefits

In addition to the strategies discussed above, there are other steps you can take to maximize your Social Security benefits. These include:

- Maximizing your earnings: The more you earn during your working years, the higher your Social Security benefits will be.

- Delaying claiming benefits: As mentioned earlier, delaying claiming benefits can increase your monthly benefit amount.

- Working while receiving benefits: If you return to work after claiming Social Security benefits, your benefits may be reduced or even suspended.

- Exploring other income sources: Supplementing your Social Security benefits with other sources of income, such as savings, investments, or part-time work, can help you achieve financial freedom.

Maximizing your Social Security benefits is an important step towards achieving financial freedom. By understanding the different strategies available and making informed decisions, you can optimize your benefits and secure a more financially secure future for yourself and your loved ones. Remember to consult with a financial advisor or Social Security representative for personalized guidance and to ensure you are making the best decisions for your individual circumstances.

With proper planning and execution, you can harness the power of Social Security to unlock financial freedom and live a more fulfilling and secure life.

4.5 out of 5

| Language | : | English |

| File size | : | 1915 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 22 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Catherine Daly

Catherine Daly Andrew Forkner

Andrew Forkner J P Medved

J P Medved J M Genest

J M Genest Carole Lawrence

Carole Lawrence David Williams

David Williams D E Mulcahy

D E Mulcahy Vicki Caruana

Vicki Caruana Mark Bibbins

Mark Bibbins Jen Mcconnel

Jen Mcconnel Carina Wilder

Carina Wilder Samuel De Freitas Martins

Samuel De Freitas Martins David W Anthony

David W Anthony Tom Owsiak

Tom Owsiak Lyudmil Tsvetkov

Lyudmil Tsvetkov Charmian Mead

Charmian Mead Jj Smith

Jj Smith Ignacio J Esteban

Ignacio J Esteban Amos Kamil

Amos Kamil Gayle Moyers

Gayle Moyers

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

DeShawn PowellHow to Care for Poinsettia Plants: A Beginner's Guide to Keeping Your Holiday...

DeShawn PowellHow to Care for Poinsettia Plants: A Beginner's Guide to Keeping Your Holiday... Emilio CoxFollow ·13.3k

Emilio CoxFollow ·13.3k Robert HeinleinFollow ·5.2k

Robert HeinleinFollow ·5.2k Neil ParkerFollow ·9k

Neil ParkerFollow ·9k Glen PowellFollow ·8.8k

Glen PowellFollow ·8.8k Amir SimmonsFollow ·19.5k

Amir SimmonsFollow ·19.5k Edwin BlairFollow ·6.6k

Edwin BlairFollow ·6.6k Leon FosterFollow ·17.7k

Leon FosterFollow ·17.7k Devin CoxFollow ·6.6k

Devin CoxFollow ·6.6k

Allen Ginsberg

Allen GinsbergUnlocking Financial Peace with Low Risk Investing: A...

In the world of investing, it is often said...

Eddie Powell

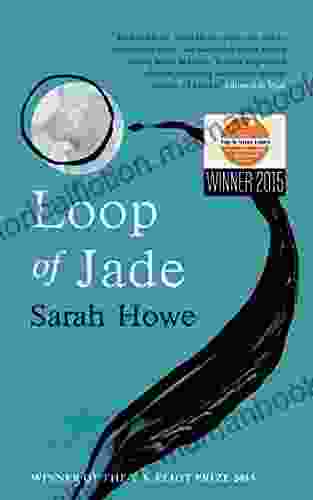

Eddie PowellLoop of Jade: An Exploration of Grief, Memory, and the...

Sarah Howe's...

Zachary Cox

Zachary CoxHealth Benefits in Retirement: Navigating the Maze of...

Retirement...

4.5 out of 5

| Language | : | English |

| File size | : | 1915 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 22 pages |

| Lending | : | Enabled |