The Ultimate Guide to PRAS and Commodity Benchmarks

PRAS (Platts Reference Assessments) and commodity benchmarks are essential tools for understanding and valuing energy markets. They provide independent, transparent, and timely information on the prices of physical commodities, such as oil, gas, and electricity. This information is used by a wide range of market participants, including producers, consumers, traders, and investors.

In this guide, we will provide a comprehensive overview of PRAS and commodity benchmarks. We will discuss the different types of benchmarks, how they are calculated, and how they are used in the energy industry. We will also provide tips on how to use PRAS and commodity benchmarks to make informed decisions about energy investments.

PRAS (Platts Reference Assessments) are a set of price assessments for physical commodities that are published by S&P Global Platts. Platts is a leading provider of information and analysis on the energy and commodities markets.

4 out of 5

| Language | : | English |

| File size | : | 1314 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 197 pages |

Commodity benchmarks are prices that are used as a reference for pricing physical commodities. They are typically based on the prices of futures contracts or spot market transactions.

There are a variety of different types of PRAS and commodity benchmarks. Some of the most common types include:

- Oil benchmarks: Oil benchmarks include Brent, WTI, and Dubai. Brent is the most widely used oil benchmark in the world. It is a blend of crude oil from the North Sea. WTI is a benchmark for light, sweet crude oil that is produced in the United States. Dubai is a benchmark for sour crude oil that is produced in the Middle East.

- Gas benchmarks: Gas benchmarks include Henry Hub, TTF, and JKM. Henry Hub is the most widely used gas benchmark in North America. It is the price of natural gas that is delivered to the Henry Hub in Louisiana. TTF is a benchmark for natural gas that is traded in Europe. JKM is a benchmark for liquefied natural gas (LNG) that is traded in Asia.

- Electricity benchmarks: Electricity benchmarks include the day-ahead and real-time prices for electricity that are traded on power exchanges.

PRAS and commodity benchmarks are calculated using a variety of different methods. Some of the most common methods include:

- Futures contracts: Futures contracts are agreements to buy or sell a commodity at a specified price on a future date. The prices of futures contracts are used to calculate commodity benchmarks.

- Spot market transactions: Spot market transactions are the buying and selling of commodities for immediate delivery. The prices of spot market transactions are used to calculate commodity benchmarks.

- Surveys: Surveys of market participants are used to collect data on the prices of commodities. This data is used to calculate commodity benchmarks.

PRAS and commodity benchmarks are used in a variety of ways in the energy industry. Some of the most common uses include:

- Pricing: PRAS and commodity benchmarks are used to price physical commodities. They provide a transparent and independent reference point for buyers and sellers.

- Valuation: PRAS and commodity benchmarks are used to value energy assets. They provide a basis for valuing oil and gas reserves, power plants, and other energy infrastructure.

- Hedging: PRAS and commodity benchmarks are used to hedge against price risk. They allow market participants to lock in prices for future deliveries.

Here are a few tips on how to use PRAS and commodity benchmarks:

- Understand the different types of benchmarks: There are a variety of different types of PRAS and commodity benchmarks. It is important to understand the differences between these benchmarks and how they are calculated.

- Use benchmarks that are appropriate for your needs: Not all benchmarks are created equal. Some benchmarks are more suitable for certain purposes than others. It is important to choose the right benchmark for your specific needs.

- Be aware of the limitations of benchmarks: PRAS and commodity benchmarks are not perfect. They can be subject to manipulation and error. It is important to be aware of the limitations of benchmarks and to use them with caution.

PRAS and commodity benchmarks are essential tools for understanding and valuing energy markets. They provide independent, transparent, and timely information on the prices of physical commodities. This information is used by a wide range of market participants, including producers, consumers, traders, and investors.

In this guide, we have provided a comprehensive overview of PRAS and commodity benchmarks. We have discussed the different types of benchmarks, how they are calculated, and how they are used in the energy industry. We have also provided tips on how to use PRAS and commodity benchmarks to make informed decisions about energy investments.

4 out of 5

| Language | : | English |

| File size | : | 1314 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 197 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Qian Julie Wang

Qian Julie Wang Andrew Forkner

Andrew Forkner Christine Nemcik

Christine Nemcik J L Beck

J L Beck Stefan Bachmann

Stefan Bachmann Michelle Burford

Michelle Burford J M Genest

J M Genest Dmytro Bondarenko

Dmytro Bondarenko Muniya S Khanna

Muniya S Khanna Michael Laitman

Michael Laitman Vern Thiessen

Vern Thiessen Emily Tacrayon

Emily Tacrayon Madison Moulder

Madison Moulder Laurel Gallucci

Laurel Gallucci Elizabeth Williamson

Elizabeth Williamson Richard Howard

Richard Howard Sara M Burgess

Sara M Burgess Matthew L Beyranevand

Matthew L Beyranevand Tess Watt

Tess Watt Lawrence Block

Lawrence Block

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Dawson ReedFollow ·13.4k

Dawson ReedFollow ·13.4k Benji PowellFollow ·15.8k

Benji PowellFollow ·15.8k Edwin BlairFollow ·6.6k

Edwin BlairFollow ·6.6k Timothy WardFollow ·18k

Timothy WardFollow ·18k Ryan FosterFollow ·3.5k

Ryan FosterFollow ·3.5k Jules VerneFollow ·16.1k

Jules VerneFollow ·16.1k Gary CoxFollow ·17k

Gary CoxFollow ·17k Allan JamesFollow ·4.5k

Allan JamesFollow ·4.5k

Allen Ginsberg

Allen GinsbergUnlocking Financial Peace with Low Risk Investing: A...

In the world of investing, it is often said...

Eddie Powell

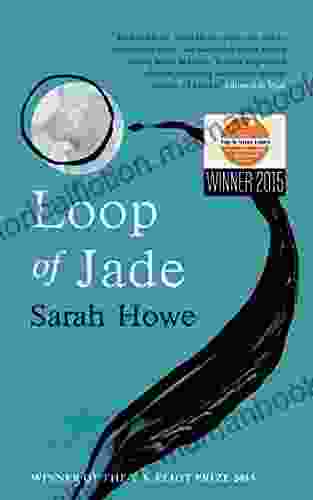

Eddie PowellLoop of Jade: An Exploration of Grief, Memory, and the...

Sarah Howe's...

Zachary Cox

Zachary CoxHealth Benefits in Retirement: Navigating the Maze of...

Retirement...

4 out of 5

| Language | : | English |

| File size | : | 1314 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 197 pages |