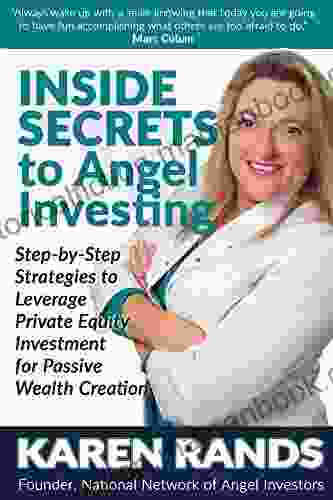

Step-by-Step Strategies for Passive Income through Private Equity Investment

Private equity investment has emerged as a lucrative avenue for investors seeking passive income and long-term capital appreciation. Unlike publicly traded stocks and bonds, private equity investments involve ownership stakes in private companies. This exclusivity often translates into higher returns but also carries greater risk. To reap the benefits of private equity while mitigating the risks, investors need a tailored strategy. This article will guide you through a comprehensive step-by-step process to leverage private equity investment for passive income.

Private equity refers to investment funds that primarily acquire and manage private companies. These funds, raised from institutional investors and accredited individuals, invest in a diversified portfolio of private businesses and seek to generate returns through capital appreciation, dividends, and exit strategies.

To invest in private equity, you must qualify as an accredited investor. Requirements may vary, but generally include an individual with a net worth exceeding $1 million (excluding the primary residence) or an annual income above $200,000 ($300,000 if combined with a spouse). Alternatively, you can invest through a private equity fund or a qualified intermediary.

4.5 out of 5

| Language | : | English |

| File size | : | 2009 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 317 pages |

| Lending | : | Enabled |

Private equity opportunities are not readily accessible to the general public. To identify suitable investments, you can:

- Network with private equity firms: Attend industry events, meet with private equity professionals, and explore their investment strategies.

- Engage with financial advisors: Work with a financial advisor who specializes in alternative investments and has access to private equity funds.

- Join private equity platforms: Consider joining online platforms that connect investors with private equity funds.

Thorough due diligence is crucial before investing. Evaluate the fund's investment strategy, track record, management team, and fee structure. Once satisfied, determine your investment amount and sign the necessary agreements.

Private equity investments require ongoing monitoring. Regularly review the fund's performance, receive updates on the portfolio companies, and attend investor meetings. Consider delegating management to a trusted financial advisor if necessary.

In addition to the core steps, additional strategies can enhance your passive income generation:

- Dividend-paying investments: Some private equity funds distribute regular dividends to investors, providing a steady stream of income.

- Capital appreciation: Private equity investments aim for long-term capital appreciation. When the fund exits an investment at a profit, investors may receive capital gains.

- Secondary market investments: You can buy and sell private equity investments on secondary markets, allowing for potential liquidity and capital appreciation.

- Long-term investment horizon: Private equity investments typically require a long holding period of 5-10 years. Be prepared to commit your资金 for the long term.

- Liquidity risk: Private equity investments are illiquid, meaning they cannot be easily converted into cash. Consider your cash flow needs and investment timeline.

- Risk diversification: Diversify your private equity portfolio by investing in multiple funds and industries to reduce risk.

- Tax considerations: Consult a tax professional to optimize your tax strategies related to private equity investments.

Private equity investment offers a compelling opportunity for passive income and capital appreciation. By following a strategic approach, understanding eligibility, diligencing investments, and implementing income-generating strategies, investors can harness the potential of this asset class. Remember, private equity investments require a long-term commitment, risk tolerance, and careful management to maximize returns while mitigating risks.

4.5 out of 5

| Language | : | English |

| File size | : | 2009 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 317 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Cassie Lowery

Cassie Lowery Amrita Suresh

Amrita Suresh William Sitwell

William Sitwell Erik Pihel

Erik Pihel Karen Rands

Karen Rands Derek R Ford

Derek R Ford Marcia Talley

Marcia Talley Shelley Marshall

Shelley Marshall Samuel De Freitas Martins

Samuel De Freitas Martins Amy Birdwell

Amy Birdwell Francesca Capaldi

Francesca Capaldi Haley Windrow

Haley Windrow Annie Bell

Annie Bell Kelvin F Jackson

Kelvin F Jackson Michelle Burford

Michelle Burford Faith Blum

Faith Blum Eugenio Florit

Eugenio Florit Pamela Roberts Lee

Pamela Roberts Lee Maria Flook

Maria Flook Eliza Earsman

Eliza Earsman

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Nathaniel PowellGoldfish Crochet Amigurumi Pattern: A Step-by-Step Guide to Creating a...

Nathaniel PowellGoldfish Crochet Amigurumi Pattern: A Step-by-Step Guide to Creating a...

Julio Ramón RibeyroJourney into the Heart of Nature: Exploring the Nature-Themed Poems of James...

Julio Ramón RibeyroJourney into the Heart of Nature: Exploring the Nature-Themed Poems of James... Henry David ThoreauFollow ·7k

Henry David ThoreauFollow ·7k Jaylen MitchellFollow ·18.9k

Jaylen MitchellFollow ·18.9k Colin RichardsonFollow ·4.2k

Colin RichardsonFollow ·4.2k Victor TurnerFollow ·7.5k

Victor TurnerFollow ·7.5k James HayesFollow ·19.9k

James HayesFollow ·19.9k Asher BellFollow ·11.6k

Asher BellFollow ·11.6k Gerald BellFollow ·4.5k

Gerald BellFollow ·4.5k Owen SimmonsFollow ·4.8k

Owen SimmonsFollow ·4.8k

Allen Ginsberg

Allen GinsbergUnlocking Financial Peace with Low Risk Investing: A...

In the world of investing, it is often said...

Eddie Powell

Eddie PowellLoop of Jade: An Exploration of Grief, Memory, and the...

Sarah Howe's...

Zachary Cox

Zachary CoxHealth Benefits in Retirement: Navigating the Maze of...

Retirement...

4.5 out of 5

| Language | : | English |

| File size | : | 2009 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 317 pages |

| Lending | : | Enabled |